24+ tax savings on mortgage

Online shopping for the best loan rates. If youre single you should.

Mortgage Interest Deduction A Guide Rocket Mortgage

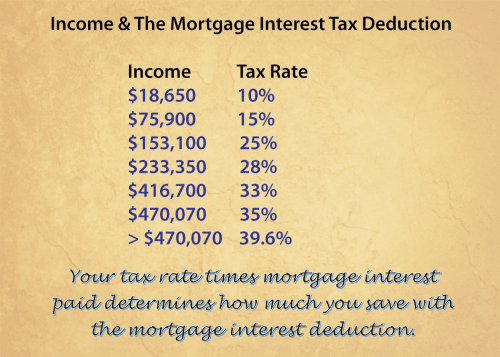

If you pay only Federal income taxes it is the highest tax bracket you used when.

. Web This is your marginal tax rate the rate at which each additional dollar of income will be taxed. Calculate Interest payment as shown below. The interest paid on a mortgage along with any points.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. For assistance in other languages please speak to a representative directly. Estimate your monthly mortgage payment.

Homeowners who bought houses before. Web Mortgage Tax Savings Calculator. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

Web What are the tax savings generated by my mortgage. Web Phone assistance in Spanish at 844-4TRUIST 844-487-8478 option 9. Mortgage amount Term in years Interest rate Federal tax rate State tax rate Monthly.

Web Your first year tax savings is 8389. Interest paid on a mortgage is tax deductible if you itemize on your tax return. Ad See how much house you can afford.

Web This calculator will help you to estimate the tax savings that you will realize due to the deductable interest and property tax payments you will make on your mortgage. Ad Dedicated to helping retirees maintain their financial well-being. Free version available for.

Web The first 12570 of taxable income per person per year is tax-free. Web In most cases you can close a checking account anytime without a financial penalty. So the total Interest that is.

So are points that are paid to lower your interest rate. Insurance - Business claims center McGriff 800-990-4228. Closing your account may be wise if you find another bank with better.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Just plug in the amount of the loan. Web The Internets leading website for home loans mortgages electronic lending and loans using the best mortgage tools on the Internet.

With the interest on a mortgage being deductible when you itemize deductions it may surprise you how much you can. The personal allowance is the amount you can earn before you start paying income tax. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Web The mortgage tax savings calculator will calculate what your potential tax savings are based on the mortgage rate you will pay on your home loan and the number of points. Email business insurance claims center. Use this calculator to determine how much you could.

Web Most homeowners can deduct all of their mortgage interest. Web Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Web With your mortgage payment property tax becomes deductible when the mortgage company pays the county.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. See if you qualify. Web The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home.

Web Insurance - Business solutions Truist Life Insurance Services 800-474-1471. X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. Web Mortgage Tax Savings Calculator Interest and points paid on a mortgage is tax deductible if you itemize on your tax return.

Web Supposing that your top marginal tax rate is 32 percent the deduction will save you 5120 on your taxes 32 percent of 16000.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

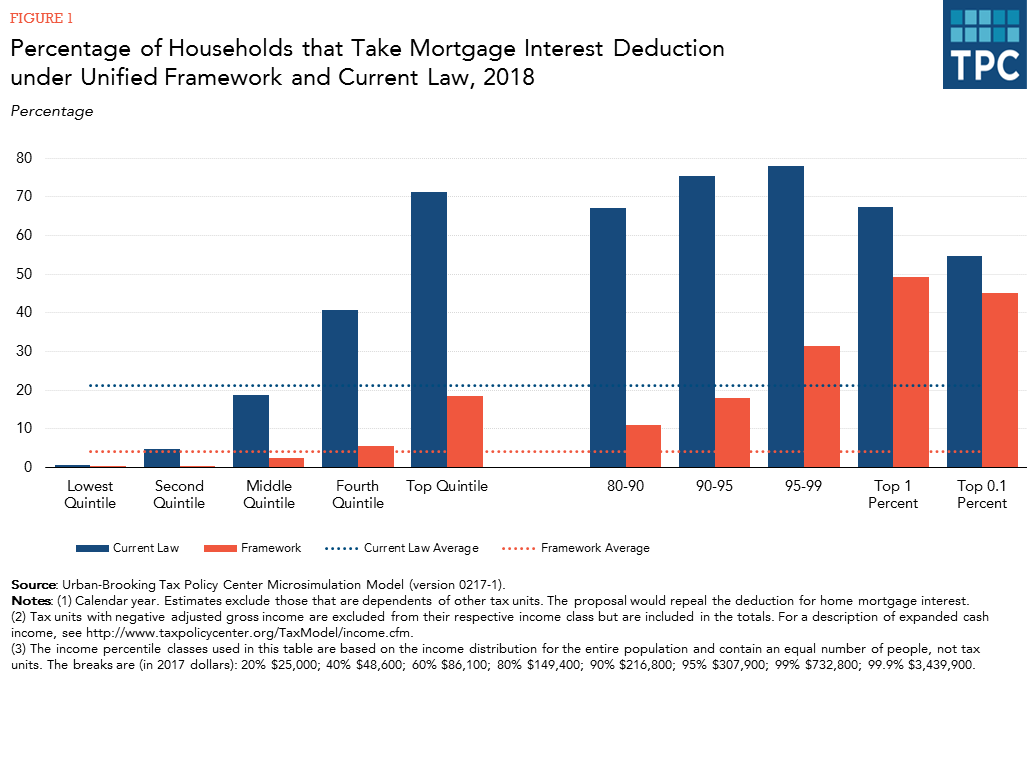

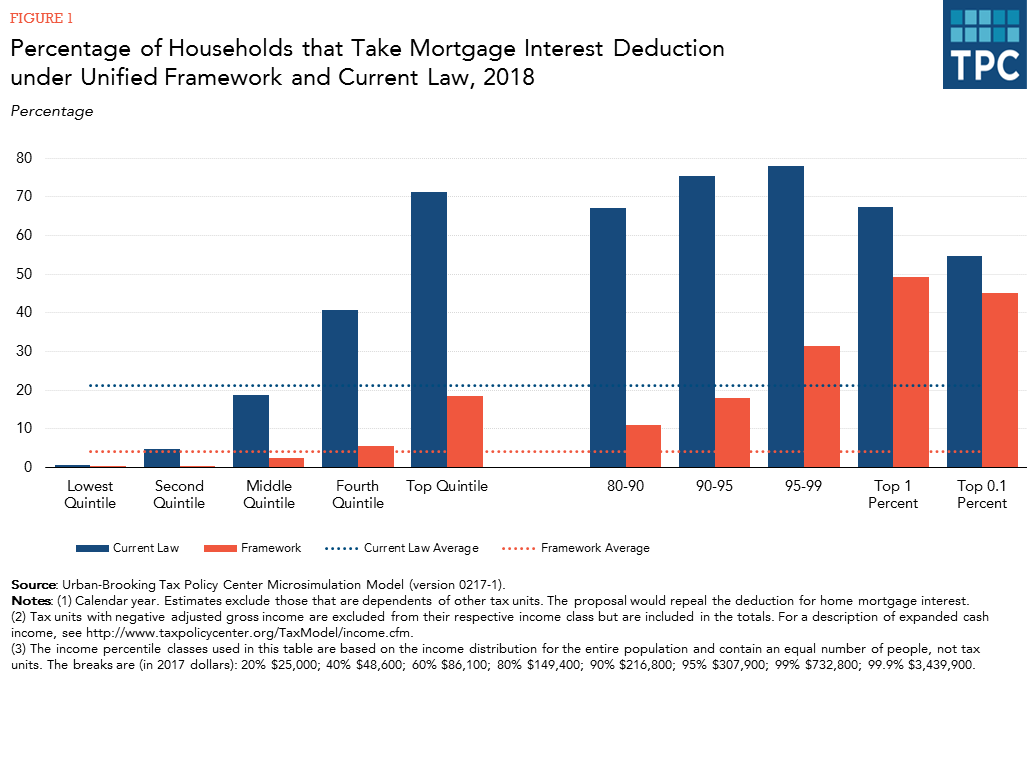

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

European Social Enterprise Monitor

N16 Forbes Eng All Pages Mar 20 By Forbes Georgia Issuu

Mortgage Broker Home Loan Expert North Perth Mortgage Choice

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Home Mortgage Interest Deduction Calculator

Mortgage Interest Deductions Tax Break Abn Amro

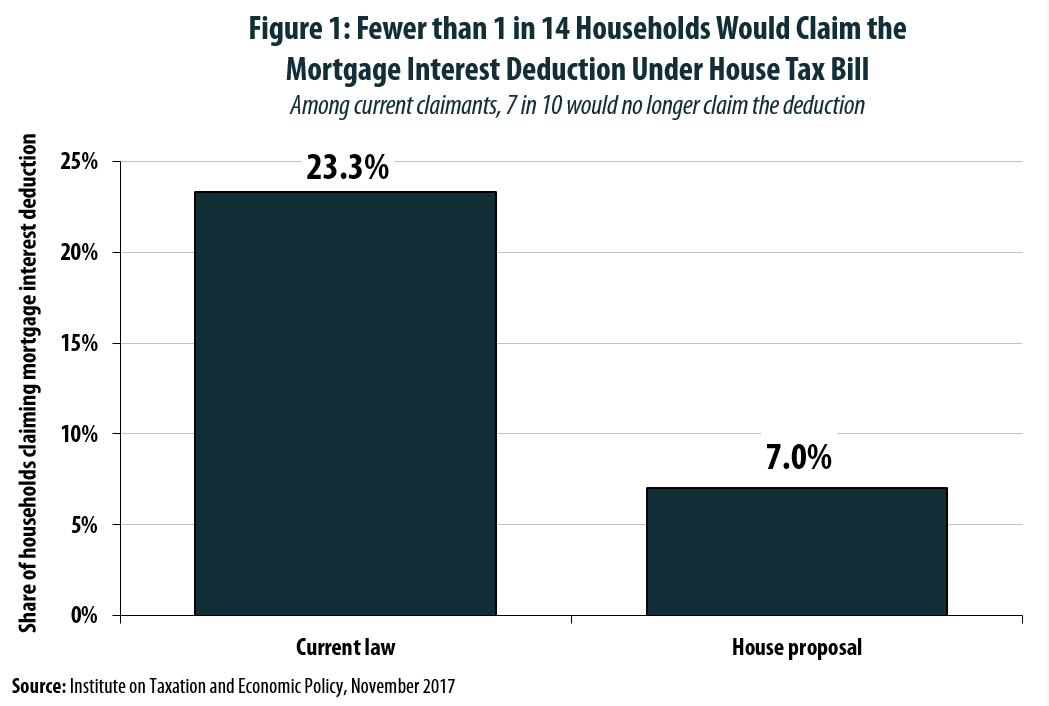

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Tax Savings Calculator

Savings Accounts First National Bank

What Is Section 24 Common Questions About Mortgage Interest Tax Relief Restrictions Less Tax For Landlords